Reliability is often treated as something that can be improved once a system is live. When things break, the focus shifts to monitoring, incident response, and recovery, with the belief that resilience can be strengthened over time as scale reveals weaknesses.

In reality, most of it is set much earlier.

Long before a system faces sustained demand, its underlying design has already shaped how it will respond under pressure. Choices about service boundaries, data handling, deployment models, and fault management influence whether a problem stays contained or spreads.

The conversation is gradually moving from reliability to resilience because distributed systems rarely operate without failure. The more useful question is how a platform continues running when parts of it inevitably fail. The sections that follow explore how early architectural decisions shape that outcome, why their impact becomes more visible at scale, and what it means to build resilience from the beginning rather than react to it later.

Early Decisions Create Long-Term Behaviour

Large-scale failures rarely emerge without warning. What appears sudden at scale is often the predictable outcome of structural decisions made earlier, when different commercial pressures shaped priorities.

In the early stages of a product, the focus is understandably on delivering value quickly, reducing development friction, and validating the market. These are rational business decisions. However, architecture chosen primarily for speed can quietly define the operational ceiling of the system, setting limits that only become visible once demand increases.

Systems Behave as They Were Built to Behave

Outages are often described as “unexpected events,” but distributed systems typically respond to pressure in ways that reflect their design. How services communicate, how state is shared, where dependencies sit, and how failure is managed all influence whether disruption remains contained within a single component or spreads across the wider platform.

Research from Google’s Site Reliability Engineering work shows that around 70% of outages are caused by changes to a live system, such as configuration updates, deployments, or operational changes, rather than by hardware failures. Similarly, the Uptime Institute’s Annual Outage Analysis identifies configuration errors and dependency failures as leading causes of major disruption.

These findings are unsurprising. In distributed environments, dependencies increase and recovery paths become harder to trace, which means that architectural shortcuts that once seemed minor can have disproportionate impact under sustained load. Systems tend to fail along the structural lines already drawn into them, and those lines are shaped by early design decisions, even when those decisions were commercially sensible at the time.

Trade-offs That Compound Over Time

Architectural decisions are rarely made under ideal conditions. Early on, speed to market matters, simplicity reduces friction, and shipping is the priority. A tightly coupled service can help teams move faster, a single-region deployment keeps things straightforward, and limited observability may feel acceptable when traffic is still modest.

But overtime, these trade-offs compound.

- Limited isolation between services makes it easier for problems in one area to affect others.

- Shared infrastructure can create hidden dependencies that only become visible under heavy demand.

Concentrated regional deployments increase the impact of a local outage or cloud disruption. - Observability that felt sufficient at launch can fall short when trying to understand complex behaviour at scale.

At a smaller scale, these constraints can go largely unnoticed. As usage increases and demand becomes less predictable, they start to shape how the system responds under pressure. What once felt manageable begins to show its limits.

This is rarely about a lack of technical ability. It is simply what happens as complexity builds over time. Every system reflects the trade-offs made in its early stages, whether those choices were deliberate or just practical at the time.

When Architecture Becomes Business Exposure

As systems grow in scale and complexity, the way they are built starts to show up in practical ways. When services are tightly connected, recovery takes longer. When failures are not well contained, a problem in one area can disrupt others. Incidents become harder to resolve and more expensive to manage.

The cost of disruption is not abstract. ITIC’s 2023 Hourly Cost of Downtime Survey reports that more than 90% of mid-size and large enterprises estimate a single hour of downtime costs over $300,000, and roughly 41% place that figure between $1 million and $5 million per hour. At that level, even short-lived incidents carry material financial impact.

For organisations that rely on digital platforms to generate revenue, those numbers represent missed transactions, operational strain, and damage to customer trust. At that point, system design is no longer just an engineering decision. It becomes a business decision with measurable financial consequences.

When Failure Is Public

Some systems fail quietly, disrupting internal workflows or back-office processes with limited external visibility. Others operate in real time, where performance issues are experienced directly by customers, investors, and partners.

In sectors such as entertainment, demand is often synchronised and predictable. Premieres, sporting events, ticket releases, and major launches concentrate traffic into specific windows, placing simultaneous pressure on application layers, databases, and third-party services. These moments are not unusual spikes; they are built into the operating model. Platforms designed for large-scale engagement are expected to handle peak demand as part of normal business activity.

That expectation changes the stakes. When performance degrades in these environments, it is noticed immediately and often publicly. Frustration spreads quickly, confidence can shift in hours, and what might have been an operational issue becomes a visible business problem.

In this context, resilience shapes whether a high-demand event reinforces confidence in the platform or exposes its limits. When failure is experienced directly by users, it moves beyond internal metrics and becomes part of the customer experience itself.

Designing for Resilience

If failure is inevitable in distributed systems, then resilience has to be built in from the start. It cannot be something added later when the first serious incident forces the issue.

Resilient systems are structured so that problems stay contained. A fault in one component should not automatically take others down with it, and services should be able to keep operating even when parts of the system are degraded. External dependencies will fail. Traffic will spike. The design needs to account for that reality.

This way of thinking shifts the focus. Instead of trying to prevent every possible issue, teams concentrate on limiting the impact when something goes wrong. Speed still matters, but so does the ability to grow without introducing instability.

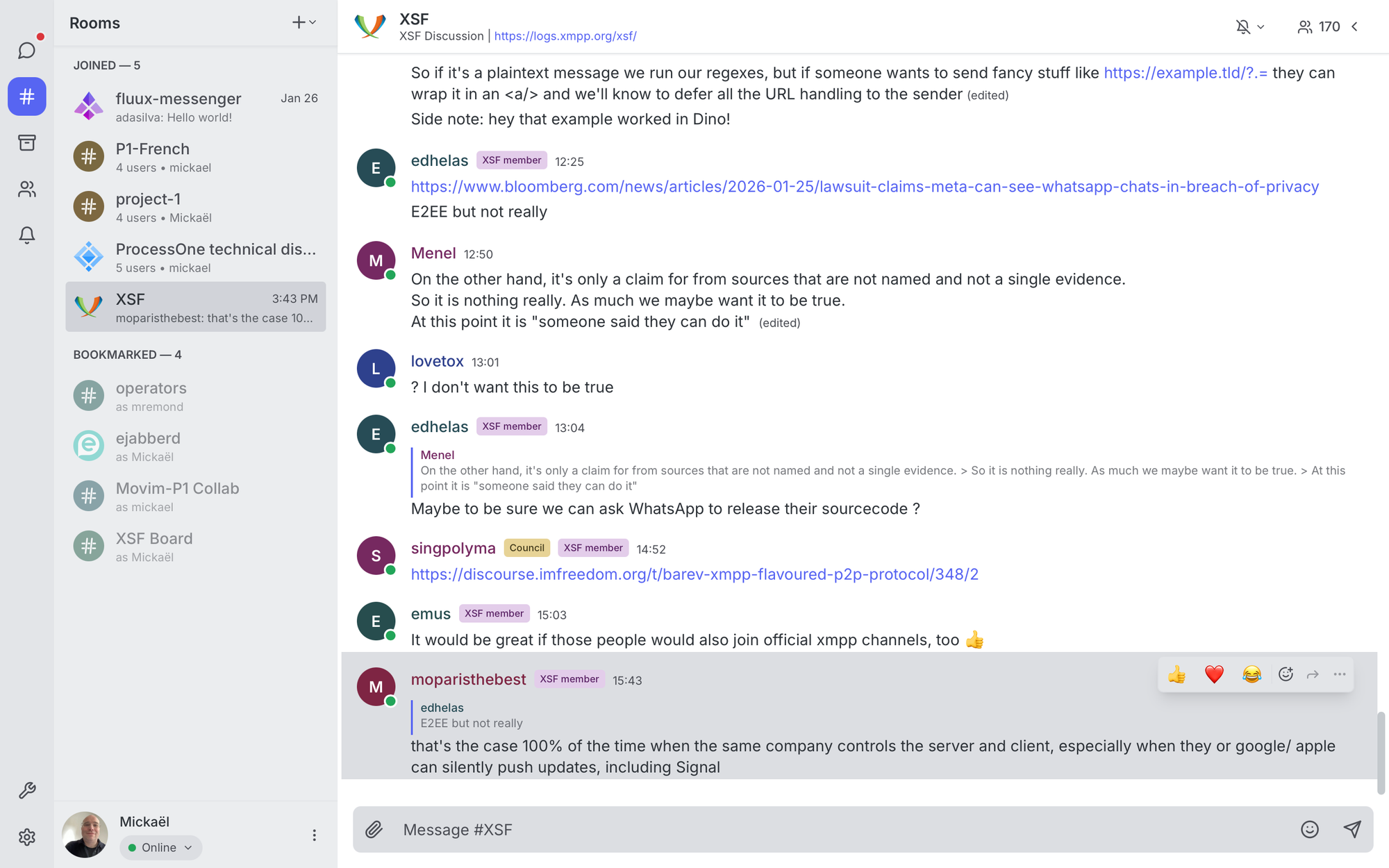

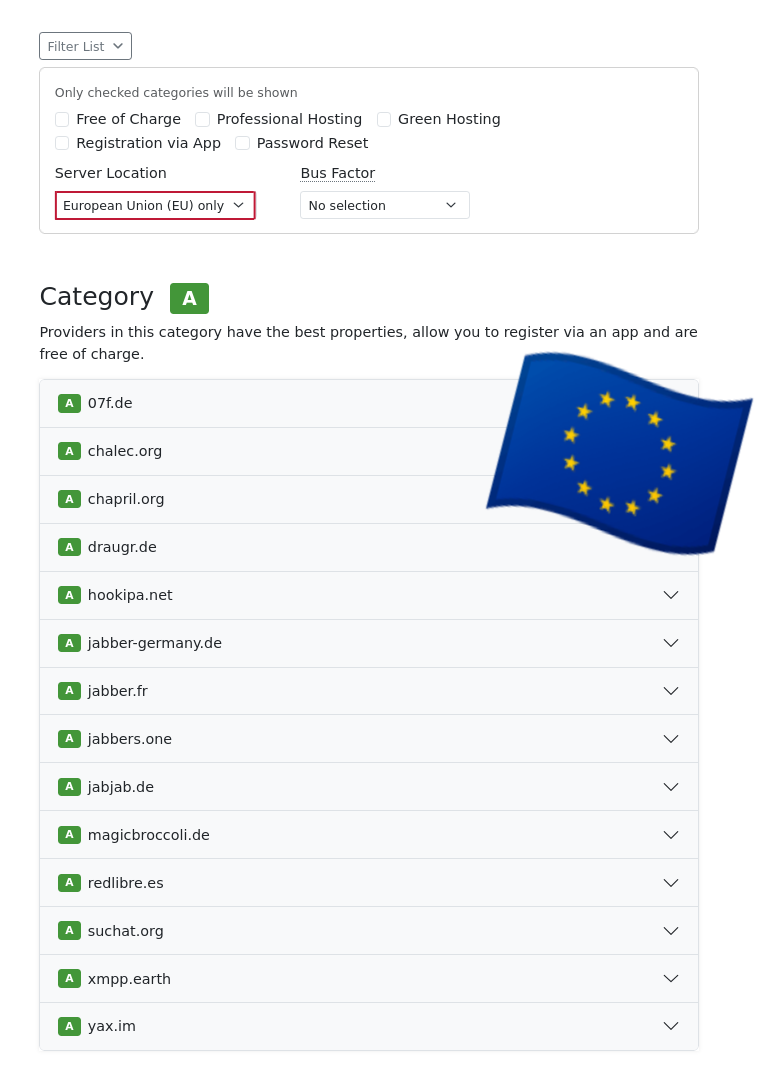

Technology choices can support that approach. Elixir programming language, running on the BEAM, was designed for environments where downtime had real consequences. Its structure reflects that:

- Applications are made up of many small, independent processes rather than large, tightly connected components.

- Failures are expected and handled locally.

- Supervision and recovery are built into the runtime so the wider system keeps running.

No language guarantees reliability, but tools built around fault tolerance make it easier to create systems that continue operating under pressure.

To conclude

By the time serious issues appear at scale, most of the important decisions have already been made.

Failure is part of running distributed systems. What matters is whether problems stay contained and whether the platform keeps operating when something goes wrong.

Thinking about resilience early makes growth easier later. It helps protect revenue, maintain trust, and avoid the instability that forces costly redesigns.If you are building distributed platforms where reliability directly affects performance and reputation, now is the time to treat resilience as a core design decision. Get in touch to discuss how to build it into your architecture from the start.

The post Reliability is a Product Decision appeared first on Erlang Solutions.